Examine This Report on Pvm Accounting

Examine This Report on Pvm Accounting

Blog Article

The Basic Principles Of Pvm Accounting

Table of ContentsGet This Report on Pvm AccountingMore About Pvm AccountingAbout Pvm AccountingExamine This Report about Pvm AccountingFascination About Pvm AccountingFascination About Pvm Accounting

Ensure that the bookkeeping process abides with the regulation. Apply needed building accountancy standards and treatments to the recording and coverage of building activity.Understand and keep typical price codes in the bookkeeping system. Interact with different financing agencies (i.e. Title Company, Escrow Business) relating to the pay application process and needs required for payment. Handle lien waiver disbursement and collection - https://dzone.com/users/5145168/pvmaccount1ng.html. Monitor and resolve financial institution concerns including fee abnormalities and check distinctions. Aid with executing and maintaining interior economic controls and procedures.

The above statements are intended to describe the general nature and level of job being executed by individuals assigned to this category. They are not to be understood as an extensive listing of obligations, duties, and abilities needed. Personnel may be required to do obligations beyond their regular duties once in a while, as needed.

Pvm Accounting for Beginners

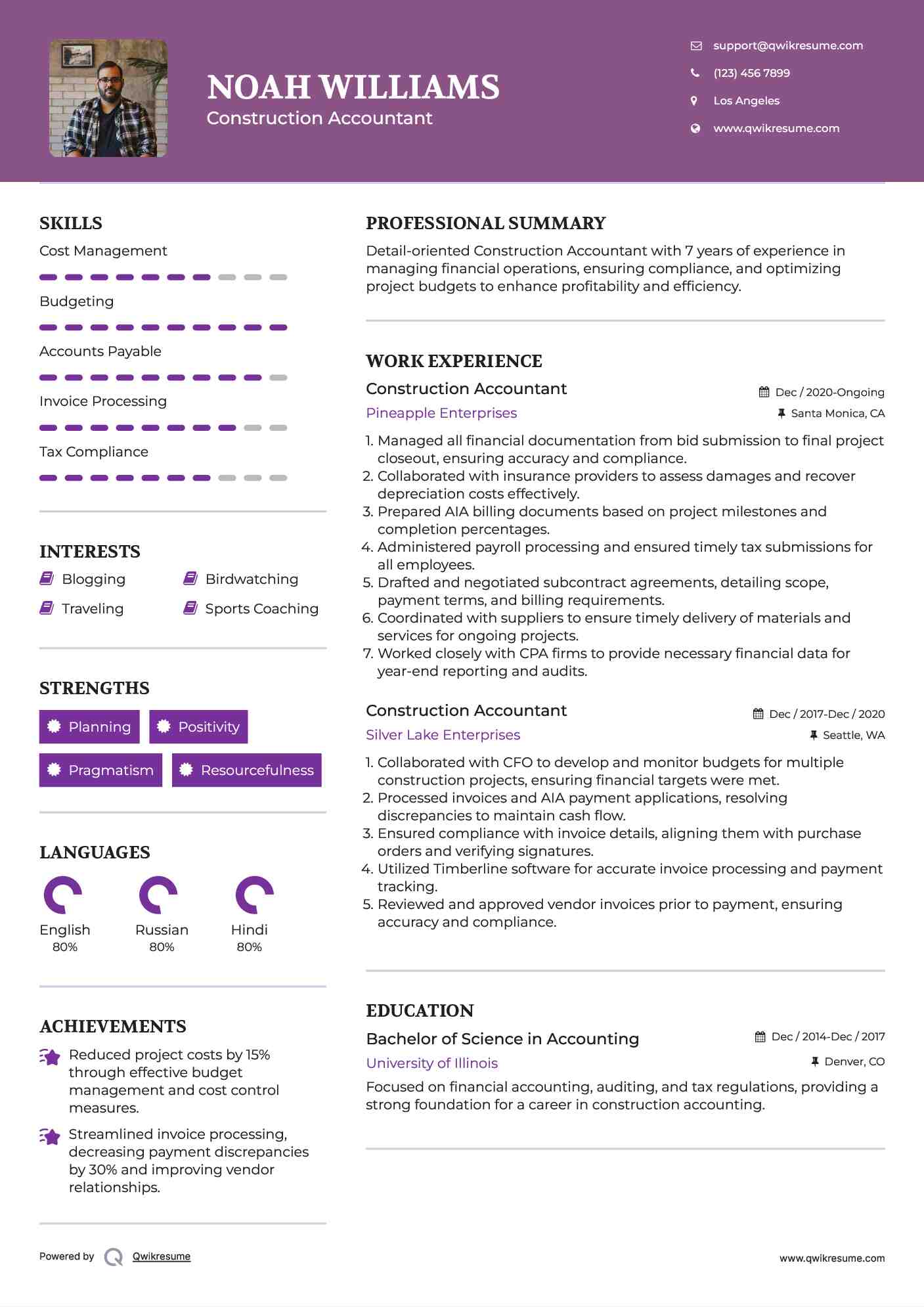

You will certainly help sustain the Accel group to guarantee shipment of effective on schedule, on spending plan, projects. Accel is looking for a Building and construction Accountant for the Chicago Workplace. The Construction Accounting professional does a selection of audit, insurance policy conformity, and task administration. Works both independently and within specific divisions to maintain financial records and ensure that all records are maintained current.

Principal tasks consist of, yet are not limited to, dealing with all accounting functions of the firm in a timely and precise fashion and giving records and timetables to the firm's CPA Company in the prep work of all financial declarations. Makes certain that all accounting treatments and functions are handled properly. In charge of all monetary records, pay-roll, banking and everyday operation of the accounting function.

Prepares bi-weekly test balance reports. Works with Job Supervisors to prepare and publish all month-to-month billings. Processes and issues all accounts payable and subcontractor settlements. Generates month-to-month wrap-ups for Workers Compensation and General Obligation insurance coverage costs. Creates month-to-month Task Expense to Date records and working with PMs to reconcile with Job Managers' budgets for each project.

The Best Strategy To Use For Pvm Accounting

Proficiency in Sage 300 Building And Construction and Realty (previously Sage Timberline Office) and Procore building and construction administration software program a plus. https://www.huntingnet.com/forum/members/pvmaccount1ng.html. Have to also excel in various other computer system software application systems for the prep work of reports, spreadsheets and various other accountancy analysis that may be called for by administration. construction taxes. Need to have strong business abilities and capability to focus on

They are the economic custodians that make sure that building and construction jobs remain on spending plan, conform with tax policies, and keep financial transparency. Construction accountants are not just number crunchers; they are tactical partners in the building procedure. Their main function is to take care of the monetary facets of construction projects, making certain that resources are assigned efficiently and economic risks are decreased.

Things about Pvm Accounting

By maintaining a tight hold on project financial resources, accounting professionals assist protect against overspending and financial troubles. Budgeting is a keystone of effective construction tasks, and building accounting professionals are instrumental in this regard.

Navigating the complicated web of tax obligation policies in the building and construction industry can be tough. Building accountants are well-versed in these laws and guarantee that the project abides with all tax needs. This consists of managing payroll taxes, sales taxes, and any various other tax obligations particular to construction. To excel in the function of a building accountant, people need a solid academic foundation in bookkeeping and finance.

Additionally, certifications such as Certified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Building And Construction Market Financial Expert (CCIFP) are very regarded in the sector. Building and construction tasks often involve tight target dates, altering policies, and unforeseen expenses.

The smart Trick of Pvm Accounting That Nobody is Discussing

Ans: Building accounting professionals create and monitor budgets, determining cost-saving chances and making certain that the project remains within budget. Ans: Yes, building accountants take care of tax obligation conformity for construction tasks.

Introduction to Building Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction firms need to make tough options amongst numerous their explanation economic choices, like bidding process on one project over an additional, selecting funding for materials or devices, or setting a task's profit margin. In addition to that, construction is a notoriously volatile industry with a high failing price, slow time to payment, and irregular money flow.

Regular manufacturerConstruction business Process-based. Manufacturing entails repeated processes with easily identifiable costs. Project-based. Production needs various procedures, materials, and equipment with differing expenses. Taken care of location. Production or production occurs in a solitary (or a number of) regulated locations. Decentralized. Each job happens in a new area with differing website conditions and unique obstacles.

9 Easy Facts About Pvm Accounting Described

Long-lasting connections with suppliers ease arrangements and boost effectiveness. Irregular. Constant use various specialized professionals and vendors impacts efficiency and money circulation. No retainage. Payment gets here in full or with normal settlements for the full agreement amount. Retainage. Some portion of repayment might be held back till task completion also when the specialist's work is ended up.

While traditional suppliers have the benefit of regulated environments and maximized manufacturing processes, building companies should constantly adjust to each brand-new task. Even somewhat repeatable jobs require alterations due to website conditions and other variables.

Report this page